Last Updated: December 2025

Reading Time: 14 minutes

Author: Papacko Content Team

You’re comparing three paper cup suppliers: Factory A quotes $0.052/cup with “ISO certified quality,” Factory B offers $0.048/cup claiming “same quality, better price,” and Factory C at $0.065/cup emphasizes “premium materials and rigorous testing.” You wire a $12,000 deposit to Factory B (lowest price), wait 60 days, and receive a container with 18% defect rate—leaking seams, inconsistent GSM, coating delamination—rendering 36,000 of 200,000 cups unusable. Your $9,600 purchase becomes $12,800 effective cost ($0.064/cup), plus lost customer orders during the scramble to source emergency replacement inventory from Factory C at expedited rates.

Paper cup supplier selection isn’t about finding the lowest price—it’s about verifying manufacturing capability, quality control systems, material consistency, and delivery reliability before committing five-figure deposits, the paper cup suppliers matter.The difference between experienced and novice buyers: $5,000-15,000 in avoidable losses per 200,000-unit order through better due diligence, factory audits, sample testing protocols, and payment term negotiation. Warning signs missed: Factory B had <2 years operating history — refused factory visit requests, provided generic certificates (not product-specific test reports), and pressured for 100% advance payment—all red flags indicating high-risk supplier.

In this guide, you’ll learn:

•Supplier vetting criteria: Factory vs trading company vs agent evaluation

•Quality verification protocols before placing orders

•Certification validation (ISO 9001, FDA compliance, FSC)

•Pricing red flags and market benchmark comparisons

•Factory audit checklists for on-site visits

•Communication and responsiveness indicators

•Building long-term supplier partnerships for consistency

Quick Takeaway:

Paper cup supplier vetting: Request 3-5 physical samples before ordering (test leak resistance, GSM, heat performance).

Verify certifications: ISO 9001 (quality management), FDA 21 CFR 176.170 (food contact), FSC (sustainable paper), check expiration dates and certificate authenticity. Factory audit critical for orders >$25,000 (verify production capacity, QC infrastructure, material storage).

Pricing benchmarks: $0.045-0.065 (12oz single-wall, FOB Asia, 100K+ MOQ), beware quotes 30-40% below market (quality compromises).

Red flags: <2 years operating history, refuses factory visits, generic certifications, 100% advance payment requests, inconsistent communication.

Payment terms: 30/70 standard (30% deposit, 70% before shipment), Letter of Credit for first orders >$30K.

Lead time: 30-45 days production + 20-30 days shipping. Quality control: Pre-production samples + during-production inspection + pre-shipment inspection (3-stage approach minimizes defect risk).

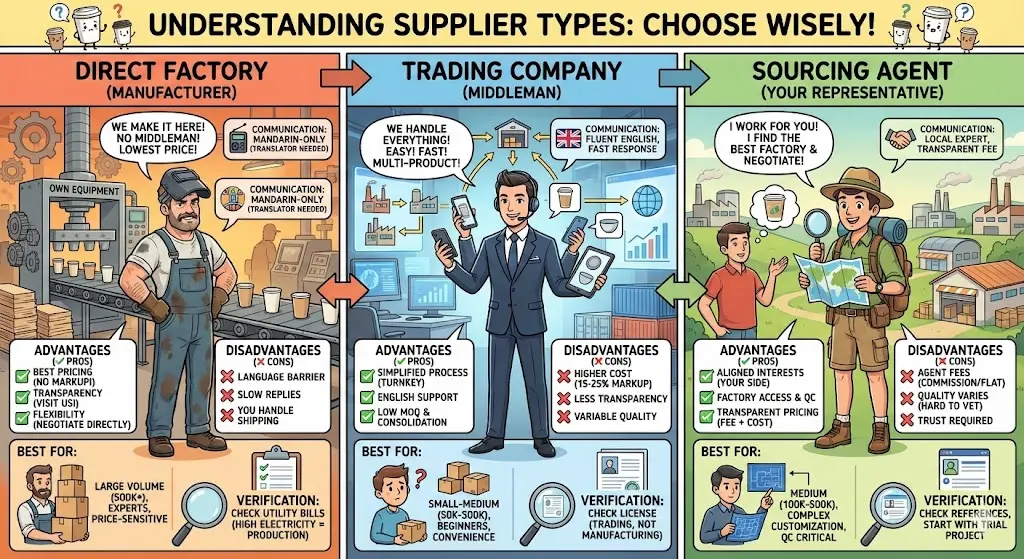

The key to choosing available paper cup suppliers depends on:

Direct Factory (Manufacturer):

Characteristics:

•Business model: Owns production equipment, employs manufacturing staff

•Direct control: Controls quality, production schedule, material sourcing

•Communication: limited English, focused on production not customer service

•Pricing: Lowest (no middleman markup)

Advantages:

•✅ Best pricing: 15-25% cheaper than trading companies (eliminate markup)

•✅ Production transparency: Can visit factory, see equipment, inspect materials

•✅ Customization flexibility: Direct negotiation on specs, materials, designs

•✅ Capacity clarity: See actual production lines, understand true capacity

Disadvantages:

•❌ Language barriers: Mandarin-only communication common (requires translator)

•❌ Limited responsiveness: Factory focused on production, slower email replies

•❌ Export complexity: May not handle logistics/documentation (you arrange shipping)

•❌ Rigid terms: Higher MOQs, less flexible on payment/delivery terms

Best for:

•Experienced importers with logistics expertise

•Large volume orders (500K+ units annually, makes direct relationship worthwhile)

•Buyers with local representatives in manufacturing country

•Price-sensitive operations where 15-25% savings justifies complexity

Verification: Request factory registration documents, utility bills (high electricity = production facility), video tour of production floor

Trading Company (Middleman):

Characteristics:

•Business model: Sources from factories, adds markup, manages export process

•Role: Intermediary between buyer and factory (handles logistics, QC, communication)

•Resources: English-fluent staff, export documentation expertise, quality control teams

•Pricing: 15-25% markup vs direct factory

Advantages:

•✅ Simplified process: Handles all logistics, customs, documentation (turnkey solution)

•✅ English communication: Fluent customer service, fast response times

•✅ Flexibility: Lower MOQs, more accommodating payment terms (absorb factory rigidity)

•✅ Multi-product sourcing: Can source cups from one factory, lids from another (consolidated shipping)

•✅ Quality oversight: Trading companies inspect goods before shipment (reduce defect risk)

Disadvantages:

•❌ Higher cost: 15-25% markup ($0.065/cup vs $0.052 factory direct)

•❌ Less transparency: May not disclose actual factory source (protect their supplier relationships)

•❌ Variable quality: Quality depends on which factory they source from (can change without notice)

•❌ Markup on everything: Custom printing, expedited production, changes = additional markups

Best for:

•First-time importers without export experience

•Multi-product orders (cups + bowls + lids from different factories)

•Small-medium volumes (50K-300K units) where service value justifies markup

•Buyers prioritizing convenience over absolute lowest cost

Verification: Check business registration (should be trading company license, not manufacturing license), request supplier references, confirm export history

Sourcing Agent (Your Representative):

Characteristics:

•Business model: You hire agent to find factory, negotiate pricing, oversee production

•Compensation: Flat fee ($500-2,000) OR commission (5-12% of order value)

•Role: Represents your interests (vs trading company represents itself)

•Location: Based in manufacturing country (China, Vietnam, etc.)

Advantages:

•✅ Aligned interests: Agent works for you (gets factory pricing, negotiates on your behalf)

•✅ Factory access: Provides factory visits, production monitoring, quality inspections

•✅ Local expertise: Knows regional suppliers, can vet factories, understands local business practices

•✅ Transparent pricing: Shows factory cost + agent fee separately (vs trading company hidden markup)

•✅ Custom assistance: Helps with complex requirements, multi-factory sourcing, logistics optimization

Disadvantages:

•❌ Agent fees: 5-12% of order value OR $1,000-3,000 flat fee

•❌ Variable quality: Agent quality varies (some excellent, some unreliable—hard to vet)

•❌ Trust required: Agent has access to your designs, supplier contacts (risk they work directly with factory later)

•❌ Learning curve: Must educate agent on your specific requirements, quality standards

Best for:

•Buyers ordering 100K-500K units (not large enough for dedicated employee, too large for trading company markups)

•Complex customization requiring close production oversight

•Quality-critical operations needing independent inspection (agent not affiliated with factory)

•Building supplier portfolio across multiple factories (agent evaluates options)

Verification: Request agent references from previous clients, check LinkedIn profile/reviews, start with small trial project before large order

Cost Comparison Example (100,000 units, 12oz cups):

Analysis:

•Factory direct cheapest ($0.052) but requires self-management

•Agent commission-based ($0.057) offers 88% of factory pricing with 80% of trading company service

•Trading company ($0.065) provides convenience worth 25% premium for first-time buyers

Understanding common paper cup suppliers requires attention to these factors:

Why Sample Testing Is Critical:

•Screen proofs lie: Actual print quality, paper texture, coating adhesion only visible in physical samples

•Specifications vary: “280 GSM PE-coated” from two factories can feel/perform differently (paper quality, coating thickness variations)

•Defect prevention: Testing 10 samples before ordering 100,000 units prevents $8,000-15,000 in unusable inventory

Sample Request Process:

Step 1: Initial Sample Request

•Quantity: 5-10 cups per size/type considering (e.g., 5 × 12oz + 5 × 16oz = 10 cups)

•Cost: Most suppliers provide free samples (you pay $15-40 shipping)

•Timeline: 5-10 business days (expedited shipping from Asia)

•Specify: Exact specs you’ll order (GSM, coating type, capacity, rim diameter)

Step 2: Physical Testing (Upon receiving samples)

Test 1: Leak Resistance (CRITICAL)

•Fill cup with water to capacity

•Wait 30 minutes at room temperature

•Inspect: No moisture at seam, base, or body

•Hot liquid test: Fill with 185-200°F water, repeat (simulates coffee/tea use)

•Fail criteria: Any leaking = reject supplier immediately

Test 2: Structural Integrity

•Squeeze test: Grip cup firmly—should resist deformation, spring back when released

•Drop test: Drop filled cup from 12 inches onto hard surface—shouldn’t split or leak

•Rim quality: Run finger around rim—smooth, consistent, no sharp edges or deformations

•Fail criteria: Cup crushes easily, deforms permanently, or rim irregular

Test 3: Coating Quality

•Visual inspection: Hold cup to light—coating should be uniform, no gaps or thin spots

•Scratch test: Gently scratch interior with fingernail—coating shouldn’t peel or flake

•Soak test: Fill with water 2 hours—paper should not absorb moisture (coating protects)

•Fail criteria: Coating peels, delamina, or allows water penetration into paperboard

Test 4: Dimensional Accuracy

•Capacity measurement: Fill with water, pour into measuring cup—verify stated capacity (12oz = 355ml)

•Rim diameter: Measure with caliper—must match standard sizes for lid compatibility (12oz = 90mm typical)

•Height: Measure cup height—verify matches specification

•Fail criteria: >5% deviation from stated specs (e.g., 12oz cup holds only 320ml = 10% under, unacceptable)

Test 5: Print Quality (If custom printing)

•Color accuracy: Compare to Pantone swatch or brand standards

•Detail reproduction: Check small text legibility (8pt minimum), logo clarity

•Print alignment: Design should be centered, not skewed or off-center

•Durability: Rub printed area with finger—ink should not smudge or transfer

•Fail criteria: Colors off by >10%, text illegible, misalignment >3mm

Test 6: GSM Verification (If GSM-critical application)

•Equipment: GSM meter ($180-250) or micrometer caliper

•Method: Measure paperboard weight or thickness at 3 points around cup

•Compare: To stated specification (e.g., stated 280 GSM, measured 260-290 GSM acceptable)

•Fail criteria: >10% deviation (stated 280 GSM, measured 240 GSM = fail)

Documentation:

•Photo each test: Visual record of pass/fail

•Create checklist: Score each supplier across all tests (objective comparison)

•Share with team: Involve stakeholders in sample evaluation (consensus on quality standards)

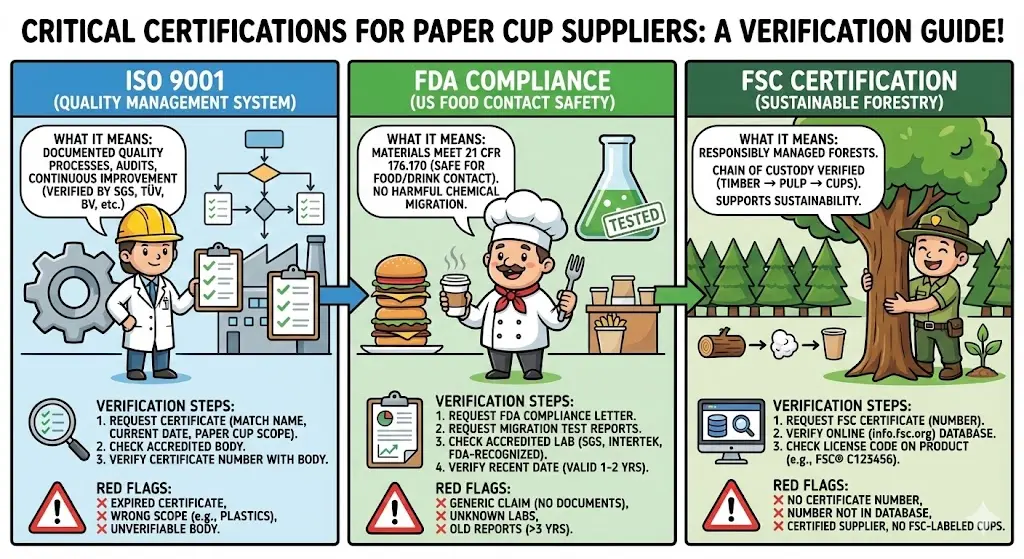

For standard paper cup suppliers, focus on:

Critical Certifications to Request and Verify:

ISO 9001 (Quality Management System):

What it means:

•Factory has documented quality processes, regular audits, continuous improvement systems

•Third-party verified by accredited certification body (SGS, TÜV, Bureau Veritas, etc.)

Verification steps:

1.Understanding various paper cup suppliers helps.Request certificate PDF: Must show company name (matches supplier), expiration date (current), scope (paper cup manufacturing)

2.Understanding common paper cup suppliers helps.Check issuing body: Search certification body name—verify they’re accredited (not fake company)

3.Understanding the paper cup suppliers helps.Certificate number: Contact certifying body to verify certificate authentic (some suppliers show fake ISO certificates)

Red flags:

•❌ Expired certificate (ISO valid 3 years, must be renewed)

•❌ Certificate doesn’t mention paper cups (e.g., certificate for “plastic products” but claiming to make paper cups)

•❌ Certification body unfamiliar or can’t be verified online

FDA Compliance (US Food Contact):

What it means:

•Materials comply with FDA 21 CFR 176.170 (paper and paperboard in contact with food)

•No migration of harmful chemicals into beverages

•Tested and verified safe for hot/cold food contact

Verification steps:

1.Request FDA compliance letter: Supplier declares materials meet FDA standards

2.Understanding common paper cup suppliers helps.Request test reports: Migration testing (cups filled with food simulant — tested for chemical leaching)

3.Understanding cup suppliers helps.Check test lab: Reports should be from accredited lab (SGS, Intertek, BV, or FDA-recognized lab)

4.Verify date: Test reports valid 1-2 years, should be recent

Red flags:

•❌ Generic “FDA compliant” claim without supporting documents

•❌ Test reports from unknown labs or no accreditation visible

•❌ Test reports >3 years old (materials/processes may have changed)

Note: FDA doesn’t pre-approve suppliers. Suppliers self-certify compliance and provide test reports. Verify test reports from reputable labs.

FSC Certification (Sustainable Forestry):

What it means:

•Paper sourced from responsibly managed forests

•Chain of custody verified (timber → pulp → paper → cups)

•Supports sustainability marketing (“FSC-certified cups”)

Verification steps:

1.Request FSC certificate: Shows supplier’s FSC certification number

2.Verify online: Search FSC database (info.fsc.org) using certification number

3.Understanding paper cup suppliers helps.Check license code: FSC cups must show license code on product (e.g., “FSC® C123456”)

Red flags:

•❌ Supplier claims FSC but no certificate number

•❌ Certificate number not found in FSC database

•❌ Supplier certified but can’t provide FSC-labeled cups (may source FSC and non-FSC paper, verify order will be FSC)

Additional Certifications (Context-specific):

General Certification Verification Rule:

•Always request actual certificate documents (not just “we have ISO”)

•Verify certificate authenticity via issuing body website or contact

•Ensure certificates current (not expired) and scope matches product type

For available paper cup suppliers, focus on:

Baseline Pricing (12oz single-wall cups, PE-coated, plain white, FOB Asia):

Premium Options Pricing (12oz cups, 100,000 MOQ):

16oz Cup Pricing (+15-20% vs 12oz):

•Single-wall plain: $0.060-0.075 (100K MOQ)

•Ripple-wall: $0.075-0.100

•Double-wall: $0.110-0.140

Cost Components Breakdown (12oz cups, 100,000 units):

Key Insight: Legitimate profit margins 8-12%. If quote is 30-40% below market, supplier either cutting quality (cheaper materials, thinner GSM) or operating at loss (unsustainable, will cut corners later).

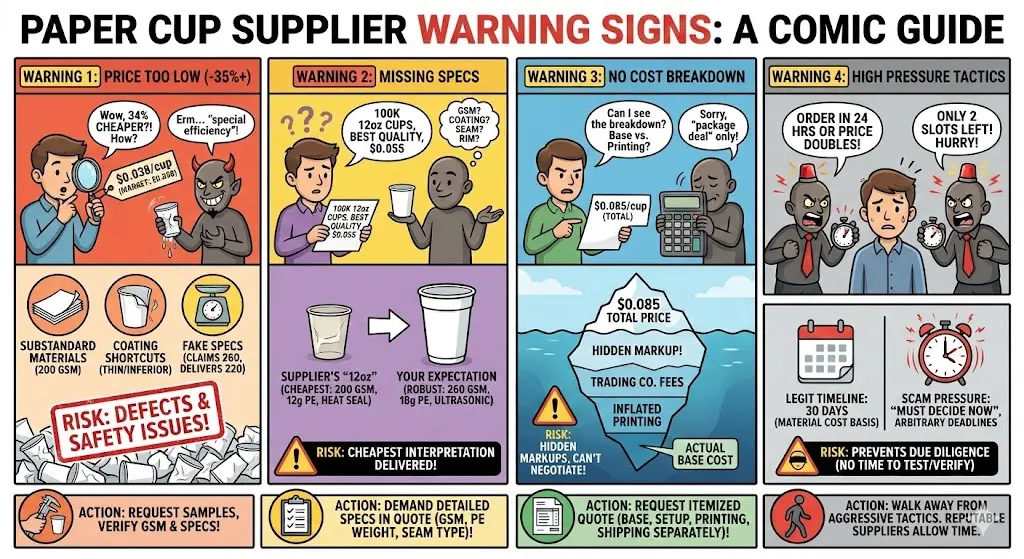

The key to choosing different paper cup suppliers depends on:

Warning Sign 1: Price 35%+ Below Market Average

Example:

•Market average: $0.058 per cup (12oz, 100K)

•Supplier quote: $0.038 per cup (-34%)

Likely explanations:

1.Understanding various paper cup suppliers helps.Substandard materials: Using 200 GSM vs 260 GSM (20-25% cost savings, inferior quality)

2.Understanding the paper cup suppliers helps.Coating shortcuts: Thin coating (12 GSM vs 18 GSM), inferior coating material (cheaper alternatives to food-grade PE)

3.Understanding paper cup suppliers helps.Fake specs: Claims 260 GSM, actually delivers 220 GSM (hope you don’t test)

4.Understanding standard paper cup suppliers helps.Bait-and-switch: Quote low to win order, deliver inferior quality, refuse refund (you’re stuck with unusable cups)

Risk: 15-25% defect rate common (vs <2% from reputable suppliers), potential food safety issues (non-compliant coatings) Action: Request physical samples, verify GSM with testing equipment, ask for detailed material specifications in contract

Warning Sign 2: Price Quoted Without Detailed Specifications

Example:

•You: “Quote for 100K 12oz paper cups”

•Supplier: “$0.055 per cup, best quality, ISO certified”

•Missing: GSM, coating type/weight, capacity tolerance, rim diameter, seam construction

Problem: “12oz cup” has 20+ specification variations:

•GSM: 200-290 (45% cost difference)

•Coating: 12-20 GSM PE (40% cost difference in coating material)

•Seam: Standard heat-seal vs ultrasonic weld (15% cost difference)

Risk: Supplier provides cheapest interpretation of “12oz cup” (200 GSM, 12 GSM coating, standard seam) vs your expectation (260 GSM, 18 GSM coating, reinforced seam)

Action: Demand detailed specifications in quote. Specify: “12oz (355ml capacity), 260 GSM paperboard minimum, 18 GSM PE coating, 90mm rim diameter, ultrasonic welded seam”

Warning Sign 3: Unwillingness to Provide Breakdown

Example:

•You: “Can you break down cost into base cup + custom printing?”

•Supplier: “Total price $0.085 per cup, no breakdown available”

Red flag reasons:

1.Understanding the paper cup suppliers helps.Hidden markups: Trading company inflating costs (e.g., base $0.055 + $0.012 printing, charging $0.085 = $0.018 markup on printing alone)

2.Understanding different paper cup suppliers helps.Flexible pricing: Without breakdown, can’t verify pricing changes for order variations (e.g., increasing quantity, removing custom printing)

3.Understanding cup suppliers helps.Negotiation disadvantage: Can’t identify where to negotiate (base price? printing? setup fees?)

Action: Request itemized quote:

•Base cup cost (per unit)

•Custom printing setup (one-time fee)

•Custom printing per unit (ink, press time)

•Shipping (separate from product cost)

Warning Sign 4: Pressure for Immediate Decision

Example:

•Supplier: “This price valid only 48 hours, order now or lose discount”

•Urgency tactics: “Raw material prices increasing next week,” “Factory production schedule filling up”

Legitimate timeline pressure (acceptable):

•“Pricing valid 30 days (based on current raw material costs)”

•“Production slot available if order placed by end of month”

Scam timeline pressure (red flag):

•“Must decide in 24-48 hours”

•“Price doubles after [arbitrary deadline]”

•“Only a few production slots left this quarter” (early in quarter)

Risk: Pressure prevents due diligence (no time to test samples, verify certifications, compare suppliers)

Action: Walk away from aggressive pressure. Reputable suppliers allow reasonable decision timelines (7-14 days standard).

Price Too High Red Flags:

Warning: Price 50%+ Above Market Without Justification

Example:

•Market average: $0.058 per cup

•Supplier quote: $0.090 per cup (+55%)

•Justification: “Premium quality”

When high price justified:

•✅ Verifiable premium materials (300 GSM vs 260 GSM, backed by test reports)

•✅ Special features (double-wall, clay-coated printing surface, advanced seam technology)

•✅ Premium certifications (organic, carbon-neutral, advanced compostability)

•✅ Exceptional service (7-day lead time vs 30-day standard, dedicated account manager)

When high price unjustified (red flags):

•❌ Vague “premium quality” claims without specifications

•❌ Middleman markup (reseller charging 50% above wholesale)

•❌ Location premium (“we’re in US, Chinese suppliers cheaper but we’re local” without commensurate service value)

Action: Request justification with evidence. Compare specifications to market average. Calculate if premium features worth extra cost for your use case.

The key to choosing common paper cup suppliers depends on:

Cost-Benefit Threshold:

•Order value >$25,000: Audit cost ($1,500-3,000) justified

•Annual volume >500,000 units: Long-term relationship justifies investment

•Custom products: Unique specifications require production capability verification

•Quality issues history: Past problems with other suppliers warrant extra diligence

Audit Types:

Virtual Audit (Video call factory tour):

•Cost: Free (supplier provides)

•Effectiveness: 40-60% (can stage tour, hide issues)

•Use: Initial screening before committing to in-person visit

In-Person Audit (On-site visit):

•Cost: $1,500-3,000 (travel + accommodation + local transport)

•Effectiveness: 90-95% (see real operations, ask spontaneous questions, inspect materials)

•Use: Before first large order (>$25K) or establishing long-term partnership

Third-Party Audit (Hire audit firm):

•Cost: $500-1,200 per audit (SGS, Intertek, BV)

•Effectiveness: 85-95% (professional inspector, detailed report, unbiased)

•Use: If you can’t travel, or want independent verification

Understanding common paper cup suppliers requires attention to these factors:

Production Capacity Verification:

What to count:

•Production lines: Number of operating cup-making machines

•Machine speed: Ask operator cups per hour (verify with observation—count cups produced in 5 minutes, extrapolate)

•Shifts: How many shifts per day (1 = 8 hours, 2 = 16 hours, 3 = 24 hours)

•Calculation: Lines × Speed × Hours = Daily capacity

Example:

•Factory claims: 500,000 cups/day capacity

•Observation: 5 production lines

•Machine speed: 10,000 cups/hour (verified by watching 5-min sample)

•Shifts: 2 shifts (16 hours)

•Actual capacity: 5 lines × 10,000/hr × 16 hrs = 800,000 cups/day

•Conclusion: Factory can fulfill claim (has excess capacity = good sign)

Red flags:

•❌ Claims 500K/day, only 2 machines visible (max 320K/day = overcapacity claims)

•❌ Equipment idle during working hours (underutilization = financial problems?)

•❌ Equipment visibly old or poorly maintained (>15 years, rust, makeshift repairs)

Quality Control Infrastructure:

QC Lab Presence:

•✅ Dedicated QC room/lab on-site (not outsourced)

•✅ Testing equipment visible:

– GSM meter (paperboard weight verification)

– Leak testers (fill cups with water, check for leaking)

– Micrometers/calipers (dimensional accuracy)

– Sample storage (approved samples from past orders for reference)

•❌ Red flag: No QC area, or “we test everything at end of production” (reactive not proactive QC)

In-Process QC:

•✅ QC inspectors on production floor (checking cups during production)

•✅ Regular sampling: Operators pulling samples every 500-1,000 cups (visible)

•✅ Defect tracking: QC recording defects on forms or computer (data-driven)

•❌ Red flag: No visible QC during production (only final inspection = defects caught late)

QC Documentation:

•✅ Test records visible: Files or computer database with past test results

•✅ Defect logs: Tracking defects by type, frequency, root cause analysis

•✅ Inspection plans: Written procedures for what to check, how oftenRed flag: “We inspect but don’t keep records” (no data = no continuous improvement)

Raw Material Storage and Handling:

Paperboard Storage:

•✅ Climate controlled: Temperature and humidity managed (paperboard sensitive to moisture)

•✅ Elevated storage: Pallets off ground (prevents moisture absorption from floor)

•✅ Organized: Different GSMs labeled and separated (prevents mixing)

•❌ Red flag: Paper stacks exposed to outdoor weather, no moisture protection

PE Coating Materials:

•✅ Fresh stock: Check manufacturing dates (should be <6 months old, PE doesn’t expire but quality degrades)

•✅ Proper storage: Sealed containers, away from heat sources

•✅ Brand-name materials: Recognize coating suppliers (DOW, ExxonMobil, etc. vs unknown brands)

•❌ Red flag: Coating drums unlabeled, open to air (contamination risk), expired dates

Ink Storage (if custom printing):

•✅ Food-safe inks: Verify FDA-compliant inks labeled

•✅ Color-coded: Different inks organized and labeled (prevents mixing errors)

•✅ MSDS sheets: Material Safety Data Sheets visible (regulatory compliance)

•❌ Red flag: Generic ink drums no labels, no MSDS documentation

Worker Training and Management:

Observation points:

•✅ Workers follow procedures: Operators reference work instructions, not improvising

•✅ Safety gear: Hairnets, gloves (food-contact product manufacturing)

•✅ Supervisor presence: Floor manager visible, answering questions, problem-solving

•❌ Red flag: Workers idle or on phones during production time, no supervision visible

Ask workers (if translator available):

•“How long have you worked here?” (high turnover = red flag)

•“What happens if you find defective cups?” (do they know procedure?)

•“Who do you report problems to?” (clear escalation = good management)

Management responsiveness:

•✅ Factory manager greets you, gives tour personally (shows they value customers)

•✅ Can answer technical questions (GSM, coating specs, production processes)

•❌ Red flag: Sales rep gives tour but can’t answer production questions, manager unavailable

Factory Cleanliness and Organization:

5S Principles (Japanese manufacturing methodology):

•Sort: Only necessary items in work areas (no clutter)

•Set in order: Everything has designated location (organized)

•Shine: Clean work areas and equipment (maintained)

•Standardize: Consistent processes and layouts (efficient)

•Sustain: Regular audits and maintenance (continuous)

Red flags:

•❌ Production floor cluttered with waste, materials scattered

•❌ Equipment covered in dust or dirt (not regularly maintained)

•❌ No clear flow: Raw materials and finished goods mixed (confusion risk)

•❌ Unpleasant odors: Chemical smells, mold (safety concerns)

Questions to Ask During Audit:

## Communication and Responsiveness

The key to choosing standard paper cup suppliers depends on:

Initial Response Time (First inquiry):

•✅ Excellent: Response within 12-24 hours (shows attentiveness)

•⚠️ Acceptable: Response within 2-3 business days (may be time zone delays)

•❌ Red flag: Response >1 week or no response (low priority customer service)

Communication Clarity:

•✅ Professional: Detailed answers, addresses all questions in email

•✅ Proactive: Asks clarifying questions about your requirements

•⚠️ Marginal: Generic responses, doesn’t fully answer questions (requires follow-ups)

•❌ Red flag: Evasive, vague, or contradictory answers (hiding information)

Technical Knowledge (Test by asking detailed questions):

Good supplier answers:

•“Our 12oz cups use 260 GSM paperboard with 18 GSM PE coating, ultrasonic welded seam, 355ml capacity”

•Shows understanding of specifications, confident in product knowledge

Poor supplier answers:

•“High quality paper cups, best price” (no technical detail)

•“Whatever GSM you want” (doesn’t understand standard specs)

•Red flag: Can’t answer basic technical questions = likely trading company without factory knowledge, or inexperienced supplier

Follow-Through (Do they do what they promise?):

•✅ Reliable: Sends quotes, samples, certificates when promised

•⚠️ Acceptable: 1-2 day delays with explanation

•❌ Red flag: Repeatedly misses deadlines, doesn’t send promised documents (unreliable)

Communication Channels:

•✅ Multiple: Email + WhatsApp/WeChat + phone (easy to reach)

•✅ Dedicated contact: Assigned account manager (consistent communication)

•⚠️ Acceptable: Email only (slower but manageable)

•❌ Red flag: Communication only through Alibaba messaging (no direct contact info = hard to reach post-order)

For standard paper cup suppliers, focus on:

Warning Sign 1: Pressure Tactics

•“Order now, price increasing tomorrow”

•“Only 2 production slots left this month” (when you inquired on 1st of month)

•“Special discount if you pay full amount today”

Legitimate urgency (acceptable):

•“Raw material costs fluctuating, quote valid 30 days”

•“Current production schedule books 4 weeks ahead”

Warning Sign 2: Evasive on Details

•You: “What GSM is the paperboard?”

•Supplier: “Industry standard” (doesn’t specify 260, 280, etc.)

•You: “Can I visit your factory?”

•Supplier: “Not convenient” repeatedly with excuses

Transparency (good supplier):

•Answers technical questions with specifics

•Welcomes factory visits (or explains why certain times better)

•Provides certificates/test reports without hesitation

Warning Sign 3: Inconsistent Information

•Initial email: “We’re manufacturer, 10 years experience”

•Follow-up: Business license shows registered 2 years ago

•Certificates: Show different company name than correspondence

Check:

•Company name consistency: Emails, certificates, website, business registration should match

•Timeline consistency: Operating history should align with registration date

•Location consistency: Factory address should match business registration address

Warning Sign 4: Poor English (Context-dependent)

When it matters:

•Complex customization: Detailed specifications require clear communication (language barrier = misunderstandings risk)

•First-time importer: You need guidance through process (poor English = frustration)

When it doesn’t matter:

•Simple products: Plain white stock cups, minimal communication needed

•You have translator: Mandarin-speaking team member can communicate

•Trading company vs factory: Acceptable for factory (focus on production), not acceptable for trading company (their value is communication)

Mitigation:

•Request detailed written specifications (less room for verbal miscommunication)

•Use photos/diagrams to clarify requirements

•Confirm critical details multiple times

Understanding common paper cup suppliers requires attention to these factors:

Year 1 vs Year 3+ Pricing (Same supplier, growing volume):

Non-Price Benefits Over Time:

•Payment terms improvement: 30/70 → 30/60/10 → Net 30 (cash flow advantage)

•MOQ flexibility: 100K standard → 50K accepted (inventory optimization)

•Priority production: Your orders scheduled first (avoid delays during busy seasons)

•Quality consistency: Factory knows your standards (fewer defects, less inspection needed)

•Innovation access: Supplier shares new products, materials with loyal customers first

Cost of Switching Suppliers:

•New supplier testing: $500-1,000 (samples, small trial order)

•Risk of quality issues: 15-25% defect rate (first orders higher risk vs established supplier <2%)

•Learning curve: 3-6 months to optimize communication, specifications

•Lost relationship benefits: Reset to Year 1 pricing, terms, service level

ROI of Loyalty:

•Switching saves: 8-12% lower price from new supplier

•Loyalty provides: 10-20% discount progression + better terms + reduced risk

•Conclusion: Loyalty often moresometimesable than switching for marginal price improvement

When evaluating various paper cup suppliers, consider the following:

Supplier Scorecard (Track quarterly):

Scoring Example:

•On-time delivery: 92% (23 points out of 25)

•Defect rate: 1.2% (28 points out of 30, excellent)

•Communication: 18hr avg response (13 points out of 15)

•Spec accuracy: 98% (19.6 points out of 20, one batch slightly off-spec)

•Flexibility: 8/10 (8 points)

•Total: 91.6/100 (Excellent supplier, maintain partnership)

Action Based on Score:

•90-100: Excellent (increase volume, negotiate better terms, long-term contract)

•80-89: Good (maintain relationship, provide feedback for improvement)

•70-79: Marginal (address issues, consider backup supplier)

•<70: Poor (switch to backup supplier, negotiate refund/compensation)

Feedback Loop:

•Quarterly review: Share scorecard with supplier (transparency improves performance)

•Praise strengths: “Your defect rate improved from 2.1% to 1.2%, excellent QC improvement”

•Address weaknesses: “On-time delivery slipped from 97% to 92%, can we discuss production scheduling?”

•Collaborative: Frame as partnership improvement, not just criticism

Defect Reporting Process:

Step 1: Document (Within 7 days of delivery)

•Photograph defects: Wide shot (pallet/carton) + close-up (individual defective cups)

•Count defects: Sample 200-300 cups randomly, calculate defect percentage

•Categorize: Leaking (critical) vs cosmetic defects (minor)

Step 2: Notify Supplier (Immediately)

•Email with photos and defect count: “Shipment #12345, defect rate 4.2% (critical leaks)”

•Request response timeline: “Please investigate and respond within 3 business days”

Step 3: Negotiate Resolution

•Options:

– Credit toward next order: Supplier deducts defect value from future invoice (e.g., 4% defect = 4% credit)

– Replacement shipment: Supplier ships replacement cups (good if you need stock urgently)

– Partial refund: Cash refund for defective percentage (if you can’t use defective cups)

– Accept with discount: If defects minor/usable, negotiate 10-20% discount on order

Step 4: Root Cause Analysis (Prevent recurrence)

•Ask supplier: “What caused defects? What corrective action being taken?”

•Good answer: “Identified machine calibration issue, recalibrated and tested, implemented hourly QC checks”

•Poor answer: “These things happen, will try to do better” (vague, no action plan)

When to End Relationship:

•3+ consecutive orders with >3% defect rate (quality not improving)

•Supplier unresponsive to defect reports (doesn’t take responsibility)

•Safety issues: Non-food-safe materials, coating problems (FDA violations risk)

Understanding the paper cup suppliers requires attention to these factors:

Business Profile:

•Company: Regional food distributor serving 150 cafes/restaurants

•Need: 800,000 paper cups annually (12oz and 16oz mix)

•Budget: Target $0.055-0.060 per cup (landed cost)

Supplier Search:

•Initial contact: 12 suppliers (8 on Alibaba, 4 from trade show)

•Quotes received: 9 suppliers (range: $0.042-0.075 per cup)

•Shortlist: 3 suppliers for detailed evaluation

Supplier A (Lowest price: $0.042):

•Red flags noticed:

– Price 28% below market average ($0.058 typical)

– Registered only 18 months (claimed “10 years experience”)

– Refused factory visit (“too busy”)

– Generic certificates (ISO 9001 not verified)

•Decision: Eliminated (too many red flags)

Supplier B (Mid price: $0.058):

•Evaluation:

– 6 years operating, moderate export history (120 containers/year)

– ISO 9001 verified, FDA compliance letter provided

– Accepted factory visit invitation

– Samples tested: 0.8% defect rate (good)

•Factory audit findings:

– 8 production lines, capacity verified

– QC lab present, testing procedures documented

– Materials properly stored

– Manager knowledgeable, transparent

•Decision: Selected as primary supplier

Supplier C (High price: $0.075):

•Evaluation:

– 12 years operating, large exporter (500+ containers/year)

– Premium materials (280 GSM vs 260 GSM standard)

– Samples tested: 0.3% defect rate (excellent)

– All certifications verified

•Decision: Selected as backup supplier (premium quality for critical orders)

Results After 18 Months:

Supplier B Performance (Primary: 600,000 cups ordered):

•On-time delivery: 94% (2 of 12 shipments delayed 5-7 days)

•Defect rate: 1.1% average (acceptable, within <1.5% target)

•Cost: $0.058 → $0.054 (7% discount after volume growth)

•Relationship: Excellent communication, flexible on rush orders

Supplier C Performance (Backup: 200,000 cups ordered):

•On-time delivery: 100% (all 4 shipments on time)

•Defect rate: 0.4% average (exceptional quality)

•Cost: $0.075 (no volume discount, maintained premium pricing)

•Relationship: Professional, reliable for urgent/critical orders

Financial Outcome:

•Average cost: (600K × $0.054) + (200K × $0.075) = $47,400 total = $0.059 per cup

•vs Budget: $0.059 vs $0.060 target = 2% under budget

•No defective batches: Zero large-scale rejections (saved $8,000-15,000 in potential losses)

Key Success Factors:

1.Eliminated lowest price (avoided likely disaster)

2.Factory audit confirmed Supplier B capability (saw operations firsthand)

3.Dual-supplier strategy (backup available when primary had delays)

4.Sample testing (caught quality issues before large orders)

When evaluating the paper cup suppliers, consider the following:

Business Profile:

•Company: Coffee shop chain (5 locations)

•Need: 500,000 cups annually

•Mistake: Chose based on price alone

Supplier Selection:

•Received 6 quotes: $0.045-0.070 per cup

•Chose supplier at $0.045 (37% below $0.060 market average)

•Skipped: Sample testing, factory visit, certificate verification

•Rationale: “Saves $7,500 annually vs $0.060 supplier, worth the risk”

Red Flags Ignored:

•❌ Price far below market (should have raised suspicion)

•❌ New company (registered 14 months ago)

•❌ Refused factory visit (“factory renovating”)

•❌ Requested 100% advance payment (vs standard 30/70)

•❌ Generic certificates, couldn’t verify authenticity

Disaster Timeline:

Day 1: Wired $22,500 (100% advance for 500,000 cups)

Day 45: Received first 250,000 cups (container 1 of 2)

Day 46: Opened cartons for use…

Quality Issues Discovered:

•Leaking rate: 22% of cups leaked within 10 minutes of filling (catastrophic)

•GSM: Measured 220 GSM (claimed 260 GSM, 18% lighter = cheaper materials)

•Coating: Delaminating when hot liquid added (coating softened at 170-180°F vs 200°F+ requirement)

•Seam failures: 8% of cups split at seam when squeezed gently

Resolution Attempts:

Week 1: Contacted supplier

•Supplier response: “These are industry standard, no problem”

•Company response: “22% defect rate unacceptable, request refund”

•Supplier: Stopped responding to emails

Week 2-4: Escalation

•Contacted Alibaba (order not through Trade Assurance, no protection)

•Hired lawyer: $2,500 consultation = “Recovery unlikely, supplier in China with no assets, legal action cost $15K-30K, low success rate”

Final Outcome:

•Container 1: Received (250K cups, 55K unusable = 22% defect)

•Container 2: Never shipped (supplier ghosted after complaint)

•Money recovered: $0 (full $22,500 loss)

•Usable cups: 195,000 × $0.045 = $0.115 effective cost (vs $0.045 quoted)

Emergency Actions:

•Sourced 305,000 cups from premium supplier at $0.082/cup = $25,010

•Total spent: $22,500 (lost) + $25,010 (emergency) = $47,510

•vs Budget: Should have spent 500K × $0.060 = $30,000

•Extra cost: $17,510 (58% over budget)

Lessons Learned (Expensive way):

1.Price 30-40% below market = red flag (not opportunity)

2.Never pay 100% advance (30/70 standard for risk mitigation)

3.Always test samples (would have caught defects before $22,500 loss)

4.Verify supplier (14 months operating, no verified history = high risk)

5.Understanding the paper cup suppliers helps.Use payment protection (Alibaba Trade Assurance, Letter of Credit for first orders)

Q1: How do I verify a supplier is a real factory, not a trading company pretending?

Verification methods:

1. Business registration check:

•Request: Business license (营业执照 in China)

•Look for: “Manufacturing” scope vs “Trading/Import-Export”

•Red flag: Registered as trading company but claims to be factory

2. Factory address verification:

•Google Maps: Search address—should be industrial zone, not office building

•Red flag: Office building address (trading company)

3. Video call factory tour (Real-time):

•Request: Live video tour of production floor

•Ask: Show today’s date written on paper held in frame (proves not pre-recorded)

•Look for: Actual equipment running, workers visible, materials stored

•Red flag: Supplier refuses video call or only shows pre-recorded tour

4. Utility bills:

•Request: Recent electricity bill

•Manufacturing: $5,000-20,000/month (heavy equipment)

•Trading office: $200-500/month (lights, computers)

•Red flag: Low electricity bill (no manufacturing operations)

5. Third-party verification:

•Services: SGS Factory Audit ($500-800), Alibaba Verified Supplier

•Result: Independent confirmation of factory existence, capability

Why it matters:

•Factory direct: 15-25% cheaper

•Trading company: Adds value (logistics, QC, communication) but charges premium

•Problem: Trading company lying as factory (gets factory pricing expectations but provides trading company service without transparency)

Q2: What’s a reasonable sample timeline and cost?

Timeline:

•Request to shipment: 3-5 business days (supplier packages and ships)

•Shipping to US/Europe: 5-10 days (expedited courier: DHL, FedEx, UPS)

•Total: 8-15 days from request to receipt

Cost:

•Sample cost: often sometimes(5-10 cups provided at no charge)

•Shipping cost: $20-45 (buyer pays, expedited international shipping)

•Exception: Custom samples may cost $50-150 (if custom printing plates needed)

Negotiation:

•Standard samples: Should be free (supplier absorbs cost as customer acquisition)

•Shipping: You pay (reasonable for supplier to charge $20-40 shipping)

•Large quantities: If requesting 50+ sample cups, supplier may charge $20-50 sample fee

Red flags:

•❌ Charges $100+ for basic samples (10 plain cups = $2-5 cost, excessive markup)

•❌ Won’t provide samples at all (no confidence in quality?)

•❌ Timeline >3 weeks (disorganized or de-prioritizing you)

Q3: Should I use Alibaba Trade Assurance or Letter of Credit?

Alibaba Trade Assurance:

How it works:

•Payment through Alibaba escrow (Alibaba holds funds)

•Supplier ships goods

•You inspect goods

•If compliant: Release payment

•If defective: File dispute, Alibaba refunds (up to coverage amount)

Advantages:

•✅ Simple: No bank involvement, easy to use

•✅ Cost: Free (no bank fees like L/C)

•✅ Protection: Up to $100,000-500,000 coverage (varies by order)

Limitations:

•⚠️ Alibaba orders only: Can’t use for direct factory orders (must transact through Alibaba)

•⚠️ Dispute resolution: Alibaba mediates (can take 30-60 days)

Best for: Orders <$50K through Alibaba platform Letter of Credit (L/C):

How it works:

•Your bank issues L/C to supplier’s bank

•Supplier ships goods + documents to bank

•Bank verifies documents match L/C terms

•Bank pays supplier if compliant

•You receive goods

Advantages:

•✅ Bank-backed: More secure than direct payment

•✅ Large orders: Standard for $50K-200K+ orders

•✅ Document control: Supplier must provide exact documents (Bill of Lading, certificates, inspection reports) or no payment

Limitations:

•❌ Cost: 0.5-1.5% of order value (bank fees)

•❌ Complexity: Requires precise L/C terms drafting

•❌ Errors costly: Minor document discrepancies can delay payment

Best for: First orders >$30K, orders >$100K, new supplier relationships requiring maximum security

Direct Payment (30/70 via wire transfer):

How it works:

•Pay 30% deposit via wire transfer

•Supplier produces goods

•Pay 70% balance before shipment

•Supplier ships goods

Advantages:

•✅ Simple: Direct bank transfer, no intermediary

•✅ No fees: Avoids Trade Assurance or L/C fees (saves 0.5-1.5%)

Limitations:

•❌ No protection: If supplier ships defective goods, dispute resolution difficult

•❌ Trust required: Suitable for established supplier relationships, risky for first order

Best for: Second+ orders with proven supplier, low-risk products, smaller orders <$15K where protection fees not justified Recommendation by Order Size:

•First order <$15K: Direct payment with 30/70 (risk manageable)

•First order $15K-50K: Alibaba Trade Assurance (simple, free protection)

•First order $50K+: Letter of Credit (maximum security for large sum)

•Subsequent orders (proven supplier): Direct payment (avoid fees)

Q4: How long should I wait for a supplier to respond to inquiries?

Acceptable timelines:

Initial inquiry (First contact):

•✅ Excellent: 6-12 hours (within same business day)

•✅ Good: 12-24 hours (by next business day)

•⚠️ Acceptable: 48-72 hours (may be time zone lag, weekend)

•❌ Poor: >1 week or no response (low priority customer service)

Quote requests:

•✅ Good: 1-2 business days (standard quote turnaround)

•⚠️ Acceptable: 3-4 business days (complex customization may need time)

•❌ Poor: >1 week (disorganized or not interested)

Sample requests:

•✅ Good: Confirmation within 24 hours, samples shipped within 3-5 days

•❌ Poor: >2 weeks to ship samples

Follow-up questions (After initial contact):

•✅ Good: Same or next business day

•❌ Poor: >3 days (deprioritizing you)

Red flags:

•Inconsistent: Fast initially, then slow after you show interest (bait-and-switch effort levels)

•Unavailable: “On holiday” frequently, long gaps between responses

•Evasive: Ignores specific questions, provides vague answers

Account for time zones:

•US-China: 12-15 hour difference (expect replies overnight US time)

•Europe-Asia: 6-8 hour difference

•Be fair: 24-hour response reasonable given time zones

When to move on:

•No response after 1 week (try 2-3 suppliers simultaneously to avoid delays)

•Pattern of slow responses (indicates low-priority treatment or disorganization)

Q5: What information should be included in a detailed supplier quote?

Comprehensive quote should include:

1. Product Specifications:

•Size: 12oz (355ml capacity)

•Material: 260 GSM paperboard

•Coating: 18 GSM PE interior coating

•Rim diameter: 90mm

•Seam: Ultrasonic welded

•Why: Ensures both parties agree on exact specs (prevents “I thought you meant…” disputes)

2. Pricing Breakdown:

•Base cup cost: $0.055 per cup

•Custom printing setup: $400 one-time

•Custom printing per cup: $0.012

•Total per cup: $0.067 (for 100K order)

3. Quantity and MOQ:

•Quote for: 100 —000 units

•Minimum order: 50,000 units

•Price tiers: 50K = $0.070, 100K = $0.067, 200K = $0.062

4. Payment Terms:

•Deposit: 30% ($6,700)

•Balance: 70% ($15,630) before shipment

•Payment method: T/T (wire transfer)

5. Lead Time:

•Production: 30-35 days after deposit + design approval

•Total: 35-40 days to ready for shipping

6. Shipping Terms:

•Incoterm: FOB Shanghai

•Packaging: 50 cups/sleeve, 1,000 cups/carton, 20 cartons/pallet

•Container: 100K cups = 1× 20ft container

7. Validity:

•Quote valid: 30 days from date issued

•Why: Raw material prices fluctuate — quote validity period protects both parties

Red flags in quotes:

•❌ Vague specs: “High quality paper cups” (no GSM, coating, dimensions)

•❌ Single total price: “$6,700 for 100K cups” (no breakdown, can’t negotiate components)

•❌ No validity period: Allows supplier to change price later

•❌ Hidden costs: Quote says “$0.067/cup” but doesn’t mention mandatory $400 setup fee

Q6: When should I consider using a sourcing agent vs going direct to factory?

Use sourcing agent when:

Scenario 1: First-Time Importer

•You: No import experience, unfamiliar with process

•Agent value: Guides through logistics, documentation, quality control

•Cost: 8-12% commission worth the education and risk mitigation

•ROI: Avoid $5,000-15,000 in mistakes (defective goods, customs delays, payment fraud)

Scenario 2: Mid-Volume Orders (100K-500K annually)

•You: Too small for dedicated sourcing employee, too large for trading company markups

•Agent value: Factory-direct pricing + professional oversight

•Cost: 8-10% commission ($4,000-6,000 on $50K annual spend)

•ROI: 15% savings vs trading company ($7,500) minus agent fee ($5,000) = $2,500 net savings + better quality control

Scenario 3: Quality-Critical Products

•You: Premium brand, quality non-negotiable

•Agent value: Independent inspections (not affiliated with factory = unbiased)

•Cost: 10-12% commission or $1,000-2,000 flat fee per order

•ROI: Avoiding 1 defective batch (5-10% defect rate = $5,000-10,000 loss) justifies agent cost

Scenario 4: Multi-Factory Sourcing

•You: Need cups, lids, bowls, containers from different factories (consolidated shipping)

•Agent value: Coordinates multiple factories, consolidates shipments, manages logistics

•Cost: 8-10% on total order

•ROI: Simplified operations (one contact vs 4 factory contacts), optimized shipping

Go direct to factory when:

Scenario 1: High-Volume Established Buyer

•You: 1M+ cups annually, 2+ years experience importing

•Direct benefit: 15-25% savings (eliminate agent/trading company markup)

•Annual savings: $50,000 order × 20% = $10,000/year

•ROI: Hire own logistics coordinator ($40K salary) = Break-even at $200K annual spend

Scenario 2: Simple Standard Products

•You: Plain white stock cups, no customization

•Direct benefit: Straightforward specs, minimal communication needed

•Agent value: Limited (product simple, less QC complexity)

Scenario 3: Established Supplier Relationship

•You: 3+ years with same factory, proven quality

•Direct benefit: Trust built, agent no longer needed for oversight

•Transition: Start with agent, go direct after relationship mature

Scenario 4: Local Presence in Manufacturing Country

•You: Office or partner in China/Vietnam

•Direct benefit: Can visit factory, communicate in Mandarin, handle logistics locally

•Agent value: None (you have in-house capability)

Decision Framework:

•First 1-2 orders: Use agent (de-risk learning curve)

•Orders 3-5: Evaluate if comfortable going direct (assess factory relationship quality)

•Long-term (>1M annually): Go direct or hire dedicated sourcing staff

Q7: What should I do if a supplier refuses a factory visit?

Legitimate reasons for refusal (Rare, but acceptable):

•Security concerns: Factory produces for major brands under NDA (tours risk IP exposure)

•Timing: “Factory under renovation March-April, visit possible after May”

•Location: Factory in remote area, difficult to arrange visit (may offer alternative: video tour, third-party audit)

How to respond to legitimate refusal:

•Video tour: Request live video call walking through production floor

•Third-party audit: Hire SGS or similar to audit factory, provide report ($500-800)

•Alternative verification: Request detailed factory photos with recent date proof, customer references

Illegitimate reasons (Red flags):

“Too busy / Not convenient” (Repeated excuses):

•Problem: If truly a manufacturer, factory tours common business practice

•Risk: Likely trading company without actual factory, or hiding poor conditions

“Policy: No customer visits”:

•Problem: Odd policy (most factories welcome visits to show capability)

•Risk: Quality issues, outdated equipment, disorganized operations to hide

Vague excuses without alternatives:

•Problem: Doesn’t offer video tour, third-party audit, or other verification

•Risk: Not legitimate manufacturer

What to do:

Option 1: Insist on Virtual Tour

•Request: “I understand in-person not possible now. Can we schedule live video tour? I’d like to see production lines, QC area, and materials storage.”

•If refused: Major red flag = eliminate supplier

Option 2: Hire Third-Party Audit

•Service: SGS, Intertek, Bureau Veritas factory audit ($500-1,200)

•Benefit: Independent inspector visits factory, provides detailed report

•If supplier refuses this: Eliminate (no legitimate reason to refuse)

Option 3: Walk Away

•Reasoning: Factory visit refusal + no alternative verification offered = unacceptable risk

•Action: Move to next supplier on shortlist

When factory visit negotiable:

•Small orders (<$10K): Cost of visit ($1,500-2,500) not justified, accept alternatives (video tour, third-party audit)

•Large orders (>$25K): Factory visit non-negotiable OR third-party audit mandatory

Never proceed without verification (Visit, video, or audit) for first order >$15,000.

Papacko offers transparent, quality-focused paper cup manufacturing with full factory verification and flexible terms for B2B buyers.

Why Choose Papacko:

•Factory transparency: Welcome factory visits, video tours, third-party audits

•Quality guarantee: <1.5% defect rate (AQL 2.5 standard), pre-shipment inspection included

•Certifications: ISO 9001, FDA 21 CFR 176.170 compliant, FSC available

•Flexible MOQs: 30,000 units minimum (lower than standard 50-100K)

•Payment terms: 30/70 standard, Letter of Credit accepted, Net 30-60 for established customers

•Communication: English-fluent team, <24 hour response time

•Product range: Single-wall, ripple-wall, double-wall, 8-24oz sizes, custom printing available

Supplier Vetting Support:

•Free sample packs (5-10 cups, you pay shipping only)

•Detailed specifications documentation (GSM, coating, dimensions, all specs clearly stated)

•Test reports: FDA migration testing, GSM verification, available upon request

•Reference customers: Connect with existing B2B clients (with permission)

Get Started:

•Request sample pack for quality evaluation

•Schedule factory video tour (live virtual walk-through)

•Receive detailed quote with specifications